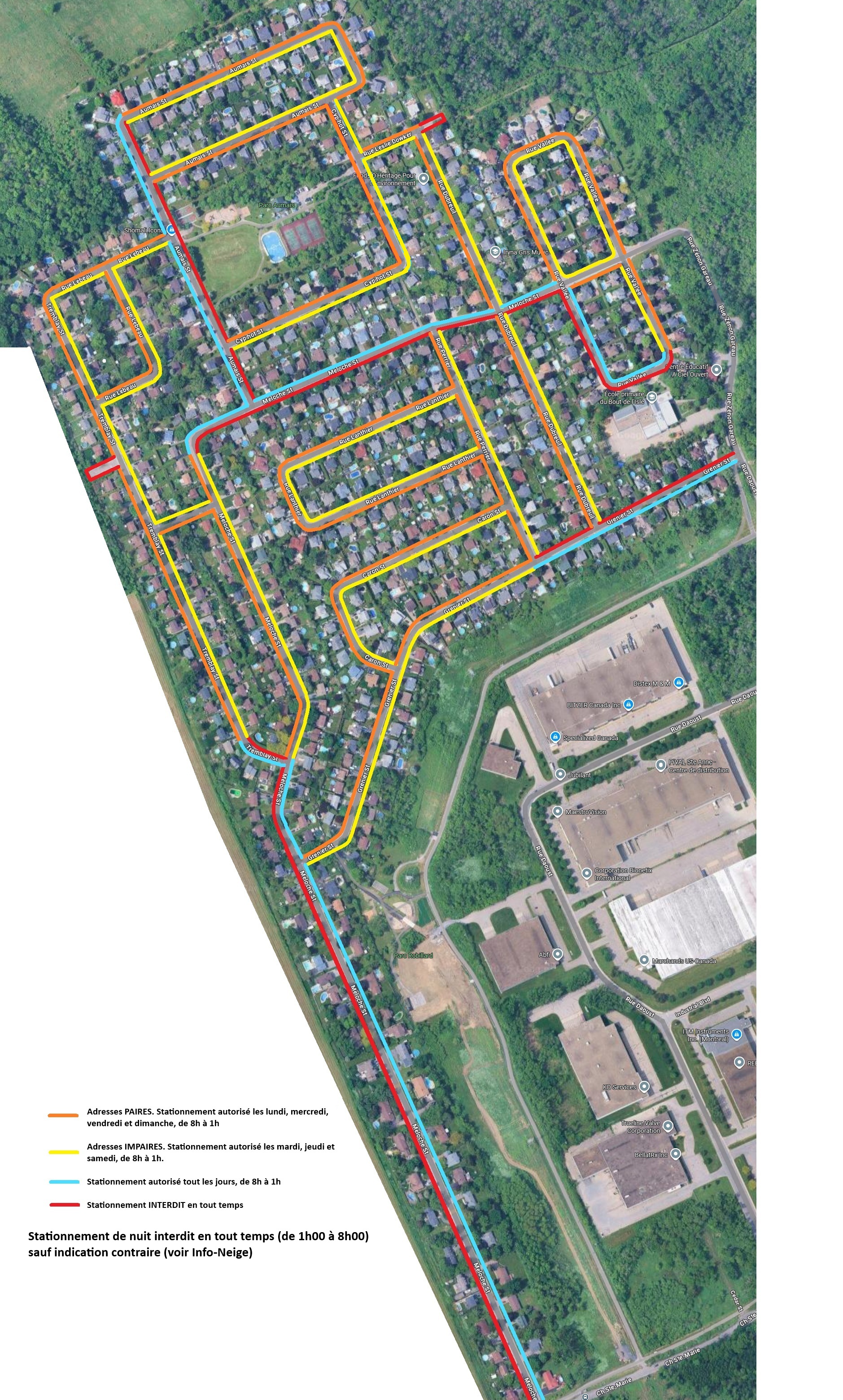

Info-neige |

2025-12-20

Stationnement de nuit - INTERDIT ❌ du 20 au 21 décembre |

|

2025-12-01

Quand le stationnement de nuit est-il permis dans le secteur nord ? |

|

Info-Travaux |

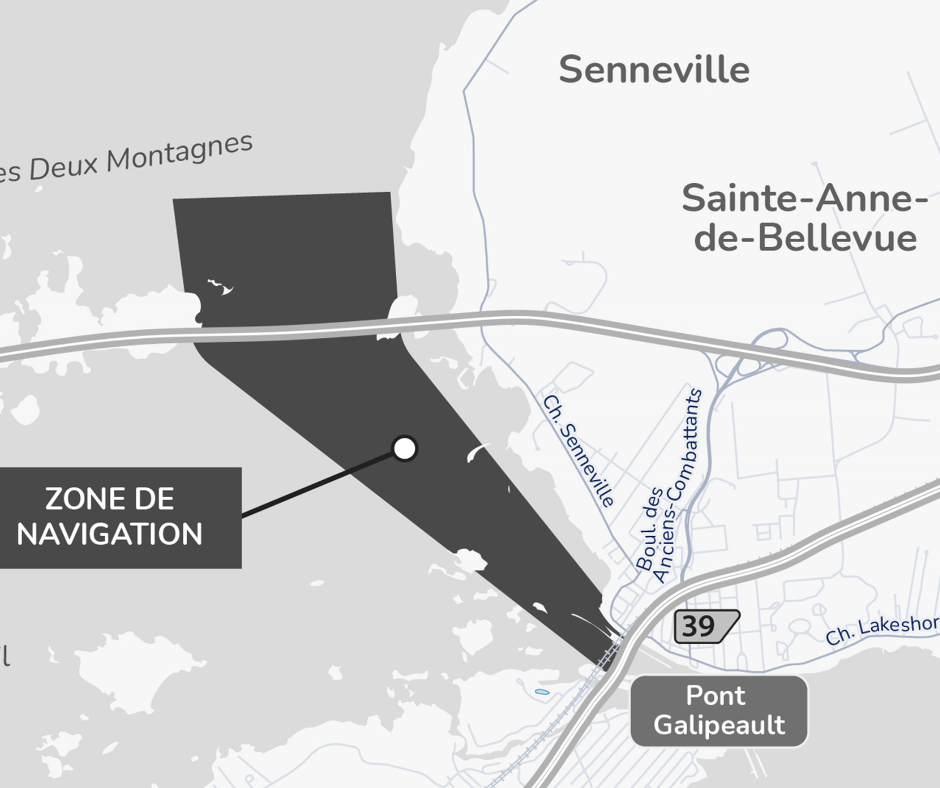

2025-12-19

Travaux de construction du pont de l’Île-aux-Tourtes - Bateaux brise-glace sur le lac des Deux Montagne et dans la baie de VaudreuilLe ministère des Transports et de la Mobilité durable vous informe que les travaux de construction du nouveau pont de l’Île-aux-Tourtes se poursuivent durant la période hivernale.

|

Info-collectes |

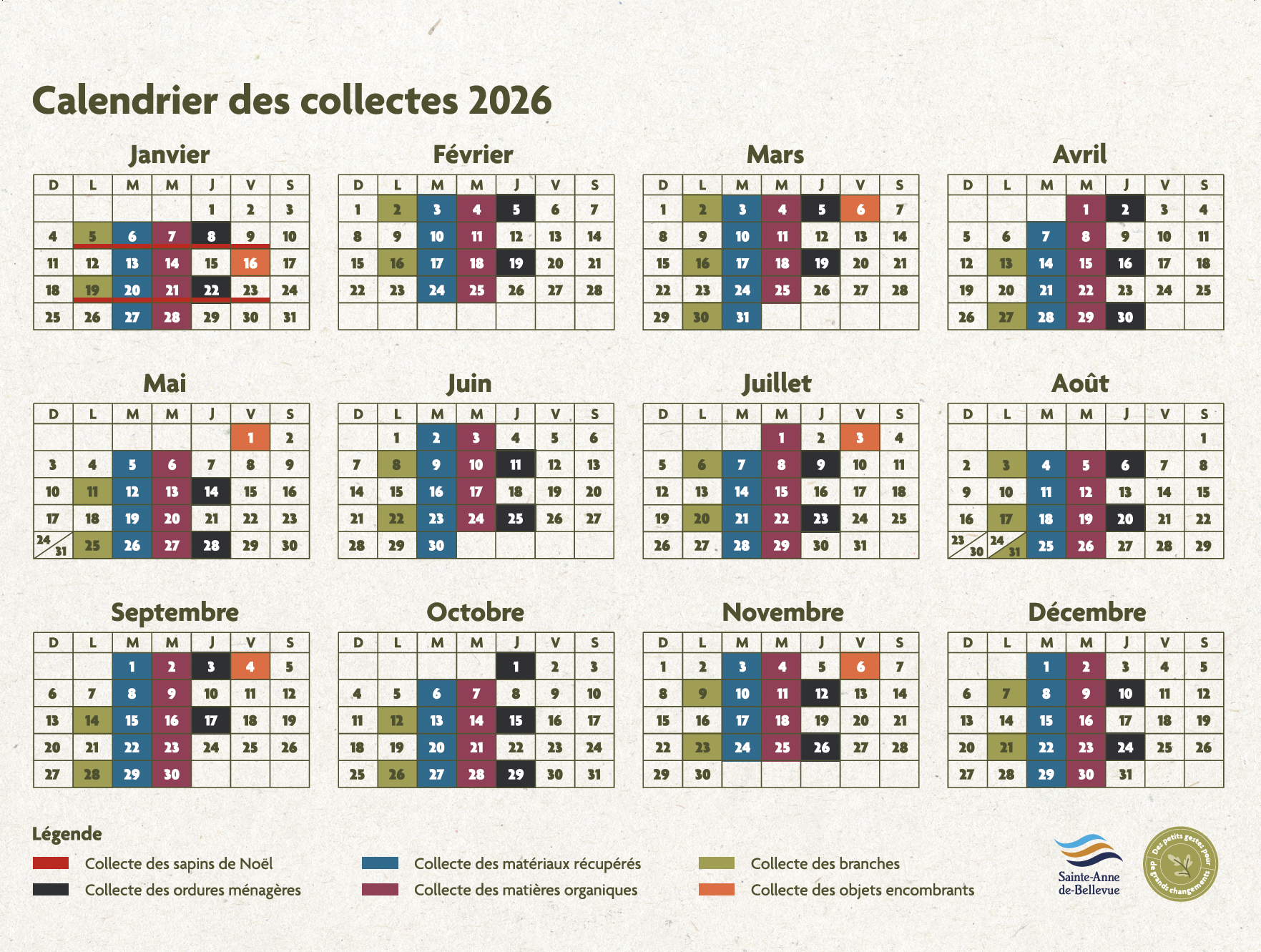

2025-12-17

Horaire des collectes pendant le temps des fêtesLa Ville vous invite à consultez l’horaire des collectes pendant le temps des fêtes.

|

|

2025-12-15

Consultez le calendrier des collectes 2026 |

Accueil

>